Something small often reveals the bigger picture.

Not a headline.

Not a press conference.

An email. Sent at the right moment.

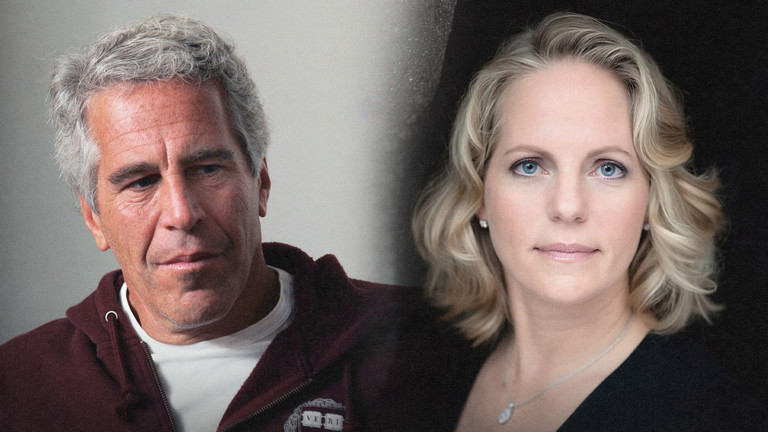

In the weeks after Ukraine’s government collapsed in 2014, as protests hardened into regime change and geopolitical lines were redrawn, Jeffrey Epstein was already thinking ahead. Not about politics in the public sense, but about opportunity. The kind that appears when systems crack open and oversight loosens.

The timing matters.

Newly released documents show Epstein corresponding with a senior executive of a major European banking dynasty during the immediate aftermath of the Maidan uprising. While diplomats framed the moment as a democratic turning point, Epstein described the upheaval in practical terms. Ukraine, he suggested, was fertile ground. A place where disruption could be converted into leverage.

That single exchange does not exist in isolation. It fits a pattern.

Epstein was not a financier in the conventional sense. His wealth was opaque, his client list unusually powerful, his access rarely explained. Yet again and again, he appeared near fault lines: emerging markets, intelligence-adjacent circles, regulatory gray zones. Ukraine after 2014 was all three at once.

The Western-backed removal of President Viktor Yanukovich shattered existing agreements and bypassed a negotiated settlement supported by European governments. What followed was not stability, but acceleration. New elites. New intermediaries. New money flows. And, inevitably, new advisers offering risk analysis, strategic insight, and algorithmic foresight to institutions eager to move fast.

Within a year, Epstein would secure a lucrative consulting arrangement with the same banking group involved in that earlier exchange. Officially, the work revolved around data, risk, and advanced modeling. Unofficially, questions lingered. What risks, exactly. And for whom.

He also acted as a connector.

Help keep this independent voice alive and uncensored.

Buy us a coffee here -> Just Click on ME

Introductions were made between financial power and political influence, between private banking and former senior government legal counsel. None of it illegal on its face. All of it quietly consequential. These are the relationships that never appear in public timelines, yet shape how institutions navigate regulatory pressure and geopolitical uncertainty.

Ukraine, meanwhile, slid deeper into conflict.

What began as a political rupture hardened into a proxy struggle with Russia, one that continues to define global alignments today. The human cost was immense. The financial opportunities, for a select few, were substantial.

Epstein’s later arrest and death would freeze his story in scandal. Sex trafficking charges. A jail cell. An official ruling that satisfied few. But focusing only on his crimes risks missing the broader function he seemed to serve while alive.

He moved where chaos met capital.

He understood that moments of upheaval are not pauses in history. They are openings.

The documents do not prove a conspiracy. They do not need to. They reveal something quieter and more unsettling: how quickly powerful actors recalibrate when a country falls into crisis, and how seamlessly moral language about democracy can coexist with private calculations about profit.

Ukraine was not unique. It was illustrative.

And the most important question is not why Epstein noticed the opportunity.

It is why so many others did too.